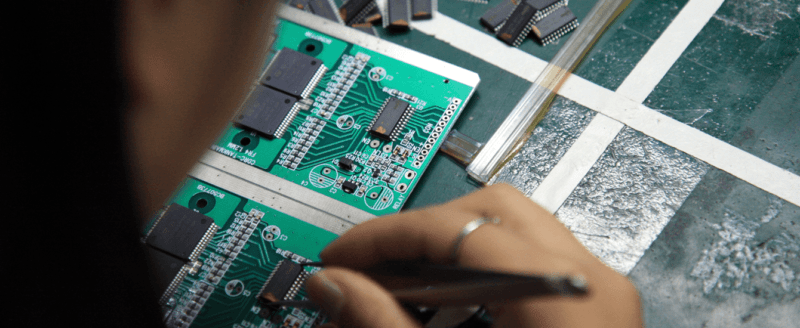

Case Manufacturing

One key element of a smartphone or tablet is the outer casing. The casing holds all the hardware together and its design is one of the fundamental USP’s (unique selling points) of the product. Design separates good products from great ones so spending sufficient time defining the design of the casing is important before stepping into manufacturing.

This manufacturing and development process will be different depending on the device you are designing for, be that a smartphone or a tablet. When you compare how casing molds are manufactured in these different product categories you will see some major differences. This is surprising considering how blurred the line is now between the smartphoneand thetablet. Daniel Weisbeck CMO and COO of Netbiscuits comments here about the merging of these markets.

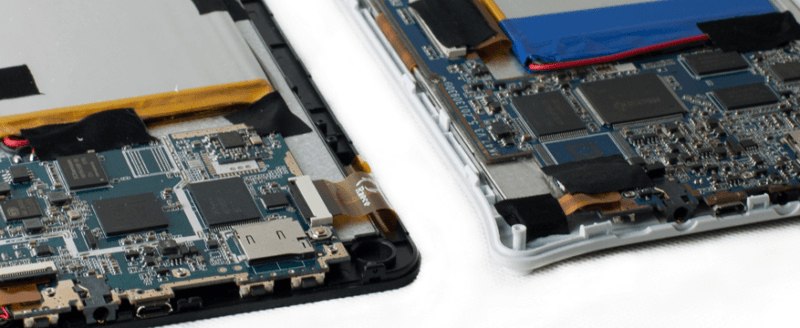

Tablet Casing

In the tablet space the Design House (A PCBA fabricator and designer) creates PCBA designs in conjunction with the Casing Factories and other design firms who design cases. The Casing Factories will design and manufacture the cases to match the PCBA designs or will work directly with the Design House when they require entirely custom PCBA’s for a client with a specific need. These will then become privately owned molds by the client or integration company. The Casing Factories will also create various public molds based on the Design House’s PCBA designs. This allows Integration Company’s to select cases from a library of public molds to save time and money when working on new projects. The factory and the client control production.

Smartphone Casing

In the smartphone market the Design House make standard PCBA layouts for smartphones that are stable and reliable. A smartphone PCBA has a lot more complexity over a basic tablet so a Design House won’t spend the time to make variations of a smartphone PCBA unless the order volume is very high. After these PCBA layouts are fabricated they are given to the Integration Company who will then design private molds to suit. It is not common for Casing Factories to create public molds for these smartphone PCBA designs, like with tablets. So the integration company controls the production and ownership of the casing mold.

It is important to realize that even though the smartphone and the tablet maybe very similar products today, they have grown from two different markets. This is why we have these differences in manufacturing. The tablet grew out of the MP3 Player market. Factories making MP3 players slowly began to produce tablets as the MP3 market died. The smartphone industry grew from the feature phone market.