Impact of supply chain problems

From the front lines of Custom Android hardware manufacturing Hatch is seeing rising material prices across the board. IC chips, metals (used in wires), and plastics have all risen. In parallel with rising prices sourcing is becoming more difficult. Many materials now have longer and unpredictable lead times. Sometimes a buyer will wait for material prices to come down. Over the past 18 months waiting only resulted in higher prices and delays since they have continued to rise.

Some parts, especially older IC chips, have less supply and longer lead times now. IC chip companies prioritize stable supply of newer chips. With limited production capacity available, production of the old ones get sacrificed. Normally when an IC goes out of production the chip manufacturer gives customers advance warning. That way customers have time to redesign the products using a newer chip. If the transition to a new IC takes too long, customers are usually still able to find stocks of the old IC to ensure a stable product supply. In today’s market stocks are becoming scarce as buyers snatch them up. Production schedules remain unpredictable, yet the older chips haven’t officially gone out of production yet. This pushes companies like Hatch and our customers to redesign products in a hurry, using more readily available IC chips. The sudden nature of this shortage resulted in delayed shipments due to the time necessary to properly redesign the product using new components.

Global shipping delays create another challenge to today’s interconnected world of global trade. Sea freight prices from China to many parts of the world are 3-4 times higher than a year ago. But just like with materials, delivery times are longer now as well. Before shipping, goods wait to board ships for longer amounts of time. Before arrival, ships wait on the water for longer amounts of time to unload.

Cause of problems

Material prices have gone up for several reasons. At the pandemic’s onset commodity prices declined steeply because of a negative global economic sentiment. Manufacturers lowered their forecasts, but product demand increased because people working and studying from home suddenly needed new electronics. This created a stark imbalance between supply and demand.

In 2020 Huawei’s orders consumed all available capacity at IC chip foundries in anticipation of the US’s ban on selling components to them. This alone impacted almost all aspects of chip production. Other large brands, seeing diminishing production capacity, placed large orders as well leaving very little supply for smaller customers. This year even large companies like Apple can’t maintain reliable supply, having issued warnings that chip shortages will reduce their profitability.

Shipping companies can’t move empty containers back to Asia fast enough. Many ports have limited staff and companies receiving the containers don’t have enough manpower to offload the goods fast enough. Limited access to containers has created a constraint on shipments. In a global economy parts come from all over the world to the location of assembly. Missing one component usually paralyzes all finished product output.

The world continues to demand digital products and many mechanical products are becoming digital. This further exacerbates demand for ICs. Household appliances have mostly become digital. Cars are packed with increasingly complex electronics. Both these important and large industries face production shortages. Statista predicts IoT devices using Bluetooth and other wireless technologies will grow from 8.74 billion units in 2020 to 25.4 in 2030, nearly a 3 times increase. This segment alone is generating massive demand.

How it’s affecting brands

Popular Android ICs, from brands like Rockchip, face shortages. Hatch uses Rockchip Android CPUs in multiple Custom Android devices. We’ve experienced this shortage first hand. Rockchip is moving customers from older chips to newer chips. This way volume is consolidated and manufacturing becomes more efficient. However as more customers migrate to a smaller number of chips the demand for those chips may soon start to outweigh supply.

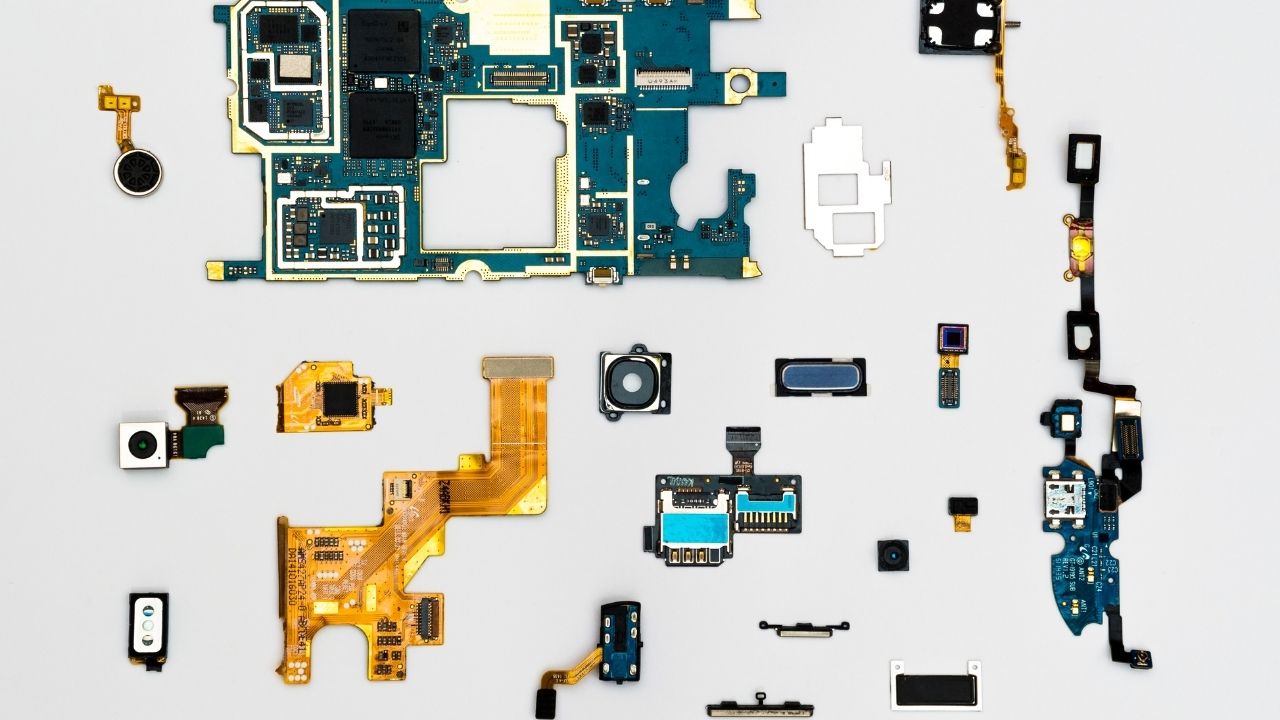

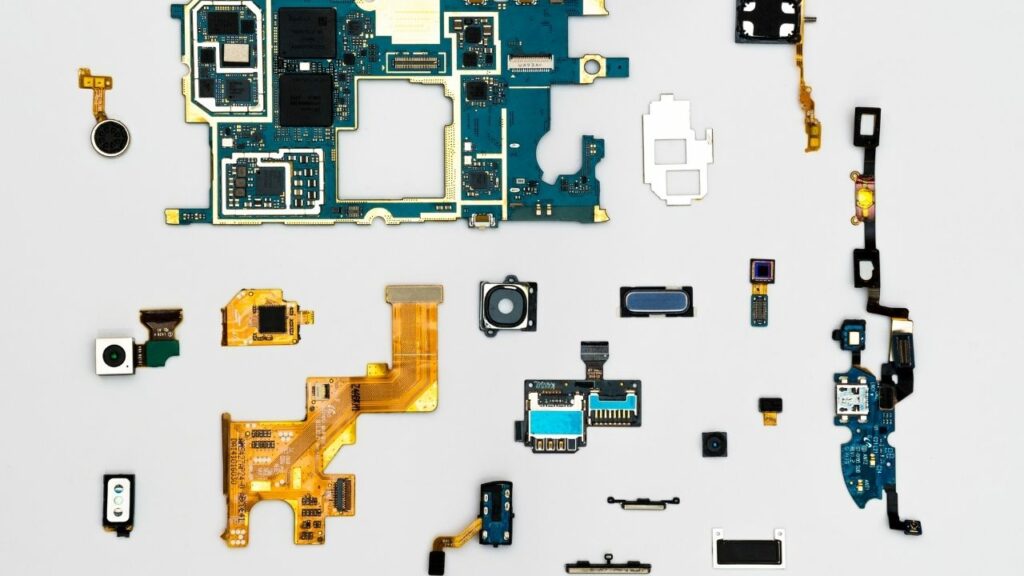

For complex products, like Android, the CPU represents just one of the multiple IC chips on the board. Even when a company finds stocks of an older Android CPU they need to find the peripheral IC chips that also go into the electronics; a WiFi chip for example. Like with finished products, a PCBA (the assembled PCB board) of an Android device, has many components. Missing any one of them delays production of the PCBA.

For one of our products Hatch used to buy a chip from Nordic Semiconductor, a leading supplier of Bluetooth chips, for $1.70. Goods consistently arrived 2 weeks after placing the order. Now, to maintain the same price, the lead time has increased to 1 year. Available stocks are selling for $4.80 to clients who can’t wait or find other options. Luckily we checked about this before needing to place an order, giving Hatch a head start on transitioning to another chip. Unfortunately making that change requires additional development cost and more time to redevelop. It’s possible we’ll have to do another production with the original, high cost, Nordic chip before the new electronics are ready for mass production (if it’s even available).

What brands can do to avoid problems

Forecast shipments more in advance. Businesses are always trying to reduce lead time as much as possible in order to have better control over inventory and expedite cash flow. As production of parts has become faster over time, the more forecasting requirements have gotten shorter. Now the inverse is happening. Companies now need to plan 6 months further in advance than before. This means more inventory risk and capital requirements for companies that sell finished products.

Reviewing your products BOM to identify risky components allows you to act early. Screens and CPUs are the hardest hit components in custom Android devices. Screen costs have more than doubled in some cases and many CPUs are experiencing shortages. Go through your BOM as early as possible to identify which components face sourcing challenges or price increases. Look for alternatives. Start to redevelop your product. In Hatch’s case we’ve taken an approach of finding available stocks for production today and redesigning products for stability tomorrow.

Like with all challenges in life and business, some companies can get out of this situation ahead and some fall behind. Hatch’s clients benefit from our connection to the pulse of this market. Problems can’t always be avoided, but they sometimes can be taken advantage of!