A list of key technical and industry terms, along with definitions, that are used when discussing custom Android tablet manufacturing projects.

Continue readingEnhancing Patient Experience: User-Centric Design Drives Adoption of Custom Android Medical Devices

User-centric design drives the proliferation of custom Android medical devices. Enhanced usability and patient empowerment redefine the healthcare experience.

Continue readingCost Savings from Android Tablet Customization

While customizing Android tablets comes with extra costs, in many situations, those costs outweigh the future costs of not doing the customizations.

We were recently approached by an organization that is procuring Android tablets for use in schools. Understandably, they are trying to get the best price for their tablets. Many schools are underfunded, so every dollar counts. They wanted to source the most generic tablets possible to leverage economies of scale cost savings and reduce development time and cost. After getting a better understanding of the use case for these specific tablets, I challenged their initial approach.

Here are important factors to consider about this specific project:

- Volume is relatively high. They are planning to procure hundreds of thousands of tablets over the next few years.

- The tablets are given to kids, not purchased by parents. This reduces the incentive for the kids to take good care of the tablets, but even with the best intentions, kids generally treat products with less care than an adult.

- The schools are located in hot climates.

- The procurement organization intends to source the tablets for 3-4 years and for the tablets to last 5 years.

There are more details to consider, but just these give enough reason to argue that the initial costs pale in comparison to the savings generated by these customizations.

Firstly, high volume is a luxury that opens many doors. Manufacturing companies love high volume as that drives down their manufacturing costs and provides reliable income. Moreover, with high volume, the one-time customization costs get amortized over a higher number of units, driving down that customization cost on a per unit basis. At the same time, if the customization makes the product better, then the added value of the customization adds the same value to all the units, while the cost required to achieve that value goes down with each repeat order.

Since the tablets are used by kids, especially kids who may not have much experience with electronics, it’s likely that the tablets will get beaten up over time. Even the most conscious people sometimes drop their own tablets or phones. This is unavoidable. Banging or dropping tablets result in broken screens, touch panels, cracked cases, or other damages that render the product unusable. Unusable devices must be replaced, repaired, or disposed of. All three of these outcomes come with a high cost. If the tablets are designed for this use case, they will survive more abuse. Designing bumpers into the case helps absorb impact on a fall. Applying a hard protective film on the touch panel increases resistance from cracking or scratching. (This isn’t a customization, just an add-on.) After thousands of recharges, USB ports sometimes get loose or break off. Fortifying the USB port by using a USB port component that has legs which go into the PCB, rather than just soldering pads that sit on the PCB, and designing the case to give support to the USB port serve to greatly reduce this risk.

Heat damages electronics. Since the schools are in hot environments, this is particularly relevant. Adding a heat sink on top of hot components, specifically the Android CPU, and designing the board in a way that hot components are spaced out, reduces heat. Avoiding designs that restrict the flow of air, such as a full silicone case around the tablet, also help to optimize heat dissipation. The protective benefit of this protective case design gets negated with excess heat that it generates. A custom tablet case with holes next to the hottest components promotes air flow. Adding a thin filter material beneath the holes serves to restrict entry of dust particles. If water penetration isn’t a concern, holes are a viable solution.

Designing a consumer product for industrial-grade performance requires changes. If product cost weighs heavily on the purchase decision, the higher upfront costs must be compared against the future cost savings. Using second-hand or lesser-known brands of important components is a common way Android tablet and smartphone manufacturers add to their profitability. Their added profitability comes at the expense of the end customer. A product with a 3-year lifespan is 25% more expensive than the same product with a 4-year lifespan.

Many of the examples of ‘customization’ mentioned above are more custom configurations than physical changes to the generic ‘off-the-shelf’ product. The others, which are real customizations, are fairly straightforward. Making a custom case definitely has a cost, but when that cost gets reduced to 1% of product cost, it’s a pretty simple decision for a high-volume product intended for long-term use. Designing a custom PCB for effective heat dissipation is relatively easy compared to having to replace thousands of units.

Hopefully, I did my job in explaining this to the customer so they consider all the factors that go into product cost, over the lifetime of the product.

Product Profile: Android Body and Security Cameras

Gadget Cannibalism

Smartphones running Android and iOS have combined many digital products into one pocket sized package. Traditional watches, when not worn for fashion or social status, have become less necessary thanks to the smartphone. Calculators, house phones, bedside clocks, MP3 players, simple digital cameras, and countless other gadgets have been eaten up by the mighty all-in-one smartphone.

A trickle of these products will continue to sell. The surviving products come from niche markets, like designer watches or a waterproof MP3 player. Also a low volume of mainstream product sales go to people who don’t want to use a smartphone for that specific purpose. For example an accountant who prefers the feel of a traditional calculator. As a company that sold a lot of MP3 players, Hatch knows the impact the smartphone had on sales of single purpose gadgets.

Beyond putting many mainstream products on the brink of extinction, Android has gotten so small, dynamic, and reliable that brands have started using it in niche products also. This article will review how Custom Android hardware is accelerating the creation of new single purpose products.

Benefits of an Android Body Camera or Security Camera

Custom Android hardware has brought down the costs for making the mobile webcam. Before webcams were attached to a desktop or peering at you from a laptop screen. Using an Android mobile phone platform, and nothing else, a camera can instantly stream video from and to anywhere in the world with a mobile or wifi internet connection.

One use case of an internet connection, besides sending video, is the remote software update that companies can use to update the hardware. This is called an OTA, or Over The Air, update, which is common on all Android and iOS platforms. Updating the software ensures bugs are dealt with quickly and can create new revenue streams for the brand by offering more services to the users. Such as when an app expands its service offering and pushes out an update.

Body cameras, commonly worn by police officers, started gaining in popularity towards the end of the ‘00s as camera technology became smaller and less power hungry. Early cameras saved video to internal flash or a memory card. The use case sold itself: easy to capture video evidence in highly contentious and often dangerous situations.

Wall mounted security cameras usually use wire connections for electricity and data transmission. They don’t run off of batteries. Older ones used wires to connect to a central machine that received the streams from (usually) multiple cameras. The central machine records the videos of each camera.

In both of these use cases the cameras provide urgent safety information. Building these products on a Custom Android platform improves the reliability and usability. The ability to review video from these sources in real time can save lives or prevent harmful events from happening. Integrating a battery in a wall mounted security camera means that if power goes down or wires are cut the video keeps rolling.

Besides obvious benefits of connected, low power functionality, the Android platform comes with many native features that add value to the products. For example adding GPS to a body camera provides the exact location to a control center. Light or sound sensors help a wall mounted security camera with power saving, only turning on when the device senses light or sound.

Examples of Android Body and Security Cameras

Security cameras, like the one shown above, have been extremely popular for decades in businesses, public places, residential areas, and countless other locations. The systems used to rely on lots of wires to stay connected. Custom Android hardware has reduced the need for wires, reduced cost, and, with the support of battery power, can run even during power outages.

Police worn body cameras, like the one shown above, have revolutionized policing. The video evidence they create has been used to vindicate or vilify police officers and civilians who may otherwise have been misjudged. Early versions used on-board memory to store media. Improvised Android hardware architecture enhanced these products with real time streaming, communication, and location tracking.

More to come!

As Android hardware continues to become more powerful, efficient, and present in our everyday lives it will continue to expand into and create new niche products. Building on our experience of creating custom Android hardware, Hatch looks forward to undertaking your bespoke project!

Managing Android Hardware Supply Chain Instability

Impact of supply chain problems

From the front lines of Custom Android hardware manufacturing Hatch is seeing rising material prices across the board. IC chips, metals (used in wires), and plastics have all risen. In parallel with rising prices sourcing is becoming more difficult. Many materials now have longer and unpredictable lead times. Sometimes a buyer will wait for material prices to come down. Over the past 18 months waiting only resulted in higher prices and delays since they have continued to rise.

Some parts, especially older IC chips, have less supply and longer lead times now. IC chip companies prioritize stable supply of newer chips. With limited production capacity available, production of the old ones get sacrificed. Normally when an IC goes out of production the chip manufacturer gives customers advance warning. That way customers have time to redesign the products using a newer chip. If the transition to a new IC takes too long, customers are usually still able to find stocks of the old IC to ensure a stable product supply. In today’s market stocks are becoming scarce as buyers snatch them up. Production schedules remain unpredictable, yet the older chips haven’t officially gone out of production yet. This pushes companies like Hatch and our customers to redesign products in a hurry, using more readily available IC chips. The sudden nature of this shortage resulted in delayed shipments due to the time necessary to properly redesign the product using new components.

Global shipping delays create another challenge to today’s interconnected world of global trade. Sea freight prices from China to many parts of the world are 3-4 times higher than a year ago. But just like with materials, delivery times are longer now as well. Before shipping, goods wait to board ships for longer amounts of time. Before arrival, ships wait on the water for longer amounts of time to unload.

Cause of problems

Material prices have gone up for several reasons. At the pandemic’s onset commodity prices declined steeply because of a negative global economic sentiment. Manufacturers lowered their forecasts, but product demand increased because people working and studying from home suddenly needed new electronics. This created a stark imbalance between supply and demand.

In 2020 Huawei’s orders consumed all available capacity at IC chip foundries in anticipation of the US’s ban on selling components to them. This alone impacted almost all aspects of chip production. Other large brands, seeing diminishing production capacity, placed large orders as well leaving very little supply for smaller customers. This year even large companies like Apple can’t maintain reliable supply, having issued warnings that chip shortages will reduce their profitability.

Shipping companies can’t move empty containers back to Asia fast enough. Many ports have limited staff and companies receiving the containers don’t have enough manpower to offload the goods fast enough. Limited access to containers has created a constraint on shipments. In a global economy parts come from all over the world to the location of assembly. Missing one component usually paralyzes all finished product output.

The world continues to demand digital products and many mechanical products are becoming digital. This further exacerbates demand for ICs. Household appliances have mostly become digital. Cars are packed with increasingly complex electronics. Both these important and large industries face production shortages. Statista predicts IoT devices using Bluetooth and other wireless technologies will grow from 8.74 billion units in 2020 to 25.4 in 2030, nearly a 3 times increase. This segment alone is generating massive demand.

How it’s affecting brands

Popular Android ICs, from brands like Rockchip, face shortages. Hatch uses Rockchip Android CPUs in multiple Custom Android devices. We’ve experienced this shortage first hand. Rockchip is moving customers from older chips to newer chips. This way volume is consolidated and manufacturing becomes more efficient. However as more customers migrate to a smaller number of chips the demand for those chips may soon start to outweigh supply.

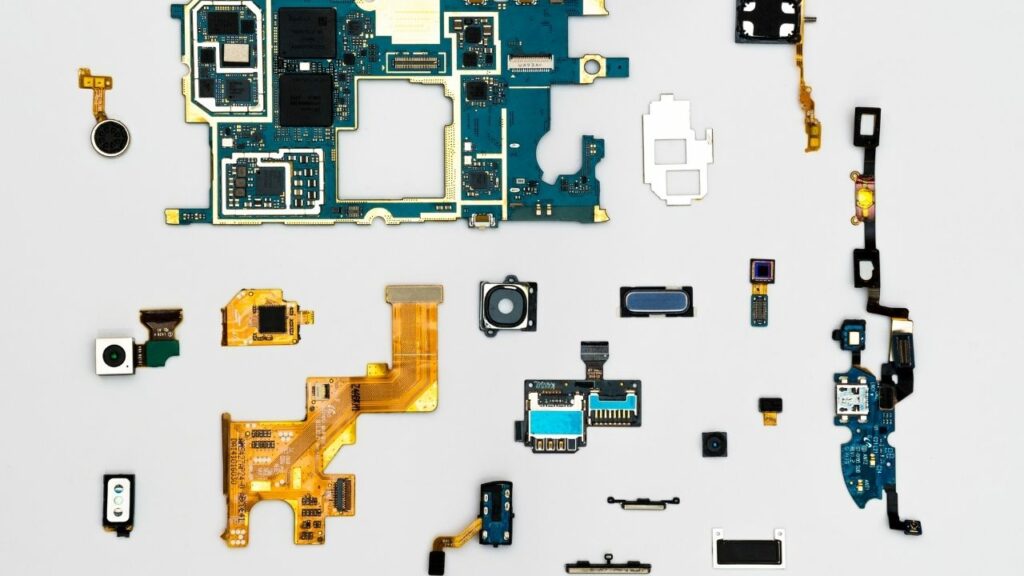

For complex products, like Android, the CPU represents just one of the multiple IC chips on the board. Even when a company finds stocks of an older Android CPU they need to find the peripheral IC chips that also go into the electronics; a WiFi chip for example. Like with finished products, a PCBA (the assembled PCB board) of an Android device, has many components. Missing any one of them delays production of the PCBA.

For one of our products Hatch used to buy a chip from Nordic Semiconductor, a leading supplier of Bluetooth chips, for $1.70. Goods consistently arrived 2 weeks after placing the order. Now, to maintain the same price, the lead time has increased to 1 year. Available stocks are selling for $4.80 to clients who can’t wait or find other options. Luckily we checked about this before needing to place an order, giving Hatch a head start on transitioning to another chip. Unfortunately making that change requires additional development cost and more time to redevelop. It’s possible we’ll have to do another production with the original, high cost, Nordic chip before the new electronics are ready for mass production (if it’s even available).

What brands can do to avoid problems

Forecast shipments more in advance. Businesses are always trying to reduce lead time as much as possible in order to have better control over inventory and expedite cash flow. As production of parts has become faster over time, the more forecasting requirements have gotten shorter. Now the inverse is happening. Companies now need to plan 6 months further in advance than before. This means more inventory risk and capital requirements for companies that sell finished products.

Reviewing your products BOM to identify risky components allows you to act early. Screens and CPUs are the hardest hit components in custom Android devices. Screen costs have more than doubled in some cases and many CPUs are experiencing shortages. Go through your BOM as early as possible to identify which components face sourcing challenges or price increases. Look for alternatives. Start to redevelop your product. In Hatch’s case we’ve taken an approach of finding available stocks for production today and redesigning products for stability tomorrow.

Like with all challenges in life and business, some companies can get out of this situation ahead and some fall behind. Hatch’s clients benefit from our connection to the pulse of this market. Problems can’t always be avoided, but they sometimes can be taken advantage of!

Product Profile: Smart Keyless Entry System and Monitoring Control

This month Hatch introduces a new kind of article, one that profiles a unique architecture for Android hardware. Overtime, as we showcase more unique hardware, you may find something which serves as a better platform to test your software than a generic Android tablet.

When Hatch first started making custom Android products around 2015 most demand revolved around mainstream retail tablet and smartphone devices. As visionaries imagined new use cases and industries created new demands, modified hardware architectures gained in popularity. One of the earliest high volume use cases that evolved from a niche are point of sale (POS) devices. Now there are several engineering and manufacturing companies that exclusively focus on this category since the global demand justifies a high level of support. Same thing is true for Rugged Android tablets and phones, however the high prices of these may still justify going custom if order volume is high enough.

Modifying hardware for a specific use case is only part of what’s needed to deliver an end product. The other, and arguably more important, part is designing the software to go with the hardware. Software entails a front end app and, usually, a back end system that interacts with the app. Once stable hardware is developed for industrial or business applications it stays the same for years, however elements of the software are regularly updated to improve user experience or resolve bugs.

Hatch sees the growing popularity of niche applications for Android as a good thing for the industry and synergistic with our business model. A new generation of niche Android products make it easier for entrepreneurs to realize their vision by running tests on existing hardware. Often existing hardware can be used for prototyping and beta testing. If testing goes well using existing hardware the next step is making custom Android hardware. Below we look at a device that’s been designed to replace the traditional keyless entry system.

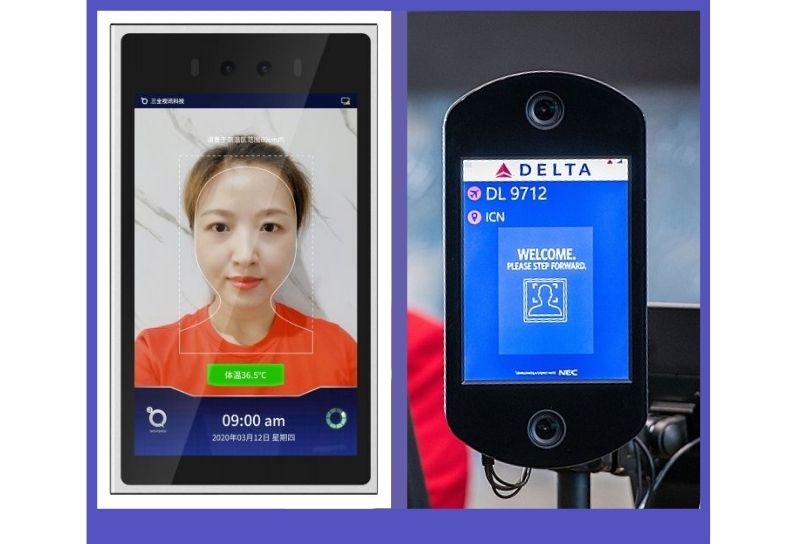

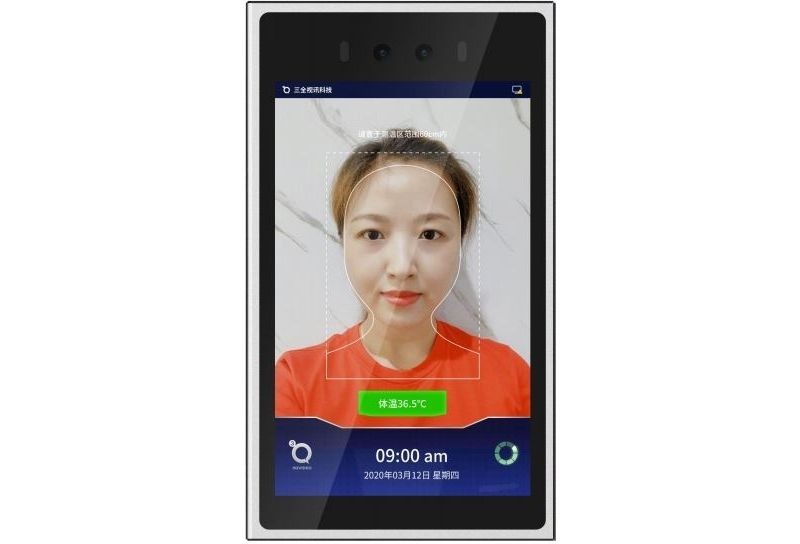

This Android device combines traditional systems with new technology. More powerful electronics supports new use cases, such as keyless entry using facial recognition. The facial database is stored in the device, either uploaded in a file or acquired using the camera, and recognition processing happens locally on the device in real time.

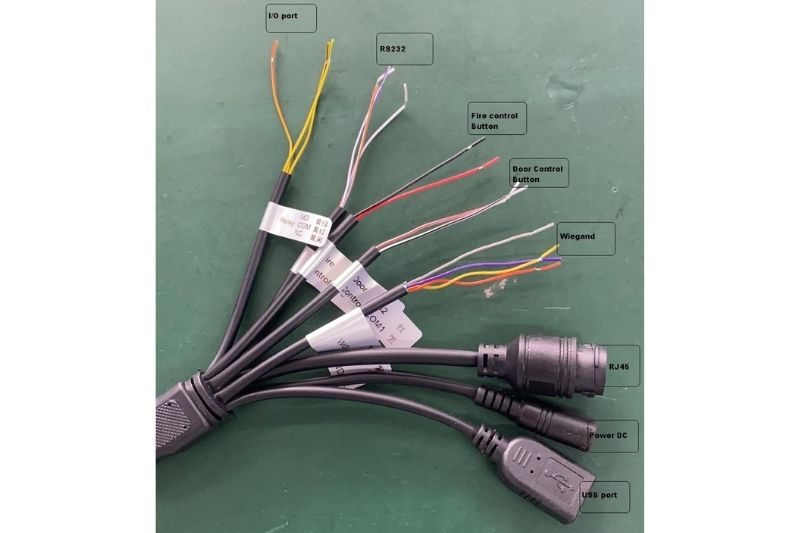

A Wiegand interface designed into the device’s motherboard connects to an external card reader. Wiegand is an older and still popular wiring protocol for connecting swipe card readers to an underlying access control system.

In addition to Wiegand there are several other interfaces including LAN (Ethernet), USB, RS-232, Power, and GPIO buttons. The RJ-45 Ethernet port can be used for PoE (power over Ethernet) or maintaining a hard-wired internet connection rather than relying on Wi-Fi. Other ports can be used for opening and closing access points mechanically or as defined by the user.

The IP65 case has been designed to withstand light rain and dust. This helps protect products exposed to rain or other outdoor conditions.

If the current architecture of the product detailed above serves your purpose better than a standard retail tablet we welcome you to use it for your initial prototype. Once you decide to make a custom version, future iterations of this product can add mobile data connectivity, body temperature sensing, or whatever customization serves your purpose best.

Covid Changed How We Live. Android Responded.

Android Devices Show Resilience Through Rapid Adaptation

Custom Android tablets are helping people push through the challenges of the Covid era. New use cases and growth in existing niches have driven innovation and demand for Android hardware.

When Covid arrived in Q1 2020 many Android manufacturing companies quickly reacted with a pessimistic outlook on business prospects for the year ahead. Key component manufacturers decreased their annual production forecasts, lowering the quantity of components produced for the whole year. Agile Chinese tablet manufacturers responded drastically. Many factories transformed their production lines to make masks, gowns, and other PPE. Engineering companies shifted attention from Android PCB design to designing digital thermometers. From one month to the next, customers went from getting price lists for tablets to price lists for medical devices and PPE from the same companies.

Covid didn’t kill economies. It halted industries. Travel, restaurants, cinemas, and many other industries have been decimated by Covid. Other industries ignited. Online education, remote working, and ecommerce/logistics, are examples of industries undergoing a renaissance with heightened user demand and investments. Many workers from the hard hit industries lost their jobs. With less disposable income people have less money to replace old phones or tablets. These were the people that industry executives thought about when reducing forecasts for component production.

What was overlooked was that if people couldn’t congregate in offices and schools then they’d need to work remotely. This created a boom in sales for Android tablets and other devices used to work or study from home.

Android’s system architecture makes it relatively easy to add different peripheral electronics to the core platform. Innovators can also quickly build apps for a wide range of use cases.

The combination of fast hardware and software development are what make Android an ideal platform for quickly adapting as the world and technology evolve.

Android products have become more than a mobile phone or tablet for the consumer market, where several global brands sell fairly similar products. The Android manufacturing ecosystem in Shenzhen quickly responds to opportunities with hardware for serious business, health, and education applications at speeds that weren’t possible until recent years.

Examples of Android Devices that Grew as a Result of the Pandemic

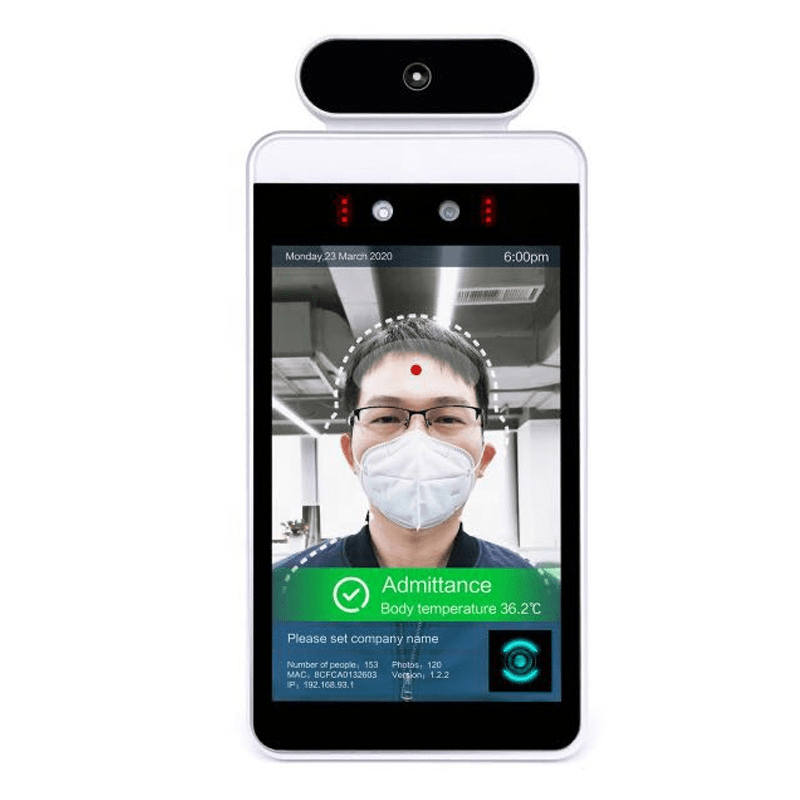

Before the pandemic started there were a few custom Android devices with access control. Once temperature testing started becoming a part of access control, temperature sensors were added to the product. Now, instead of a person taking other peoples’ temperatures at entry points for office buildings, malls, or supermarkets, a tablet does this, and much more, automatically. It takes peoples’ temperatures, assigns the temperature to a specific person, and records that information instantly for future reference as a pandemic control measure (while this raises privacy concerns that is another topic for another article).

Several different companies started making their own version of this product with little twists in design or components. Because of how many companies made their own version of this product it may not be necessary to custom make anymore since many options are available. Some of these tablets are built into a self driving robot device that approaches people for use in hospitals and restaurants.

From elementary school to colleges, remote education was forced upon students around the world. With so many students studying from home the global demand for tablets tailored to serve them exploded. While the electronics don’t vary much (or at all) from standard tablets, specialized apps and casing designs differentiate educational tablets. The huge demand for educational tablets overcompensated for the people with reduced discretionary spending and drove up component prices across the whole industry. The price increases were also a direct result of Huawei hoarding parts due to trade restrictions and reduction in production forecasts from component manufacturers, as mentioned above.

So Many Use Cases. So Many Android Custom Solutions.

Covid has brought to light how the Android platform allows for diverse and fast development of new products. Hopefully demand for pandemic related products will go down soon. Whenever that happens there will be new opportunities calling on engineers to adapt Android in new ways. If you want to bring a unique Android product to life, Hatch can help. We’re always happy to talk with entrepreneurs and engineers about your project.

Mature vs Immature Supply Chains in Custom Android Device Manufacturing

What supply chain means

In this article ‘supply chain’ refers to all the contributors of components or services that go into manufacturing a finished product. More specifically, in the case of custom Android manufacturing, that means suppliers of hardware such as screens, PCBA, cameras, cases, etc. Also different specialized service providers such as electronics, mechanics, software, and assembly engineers. General services, such as logistics, which aren’t specific to Android hardware are not covered in this article.

What’s a mature supply chain?

Supply chains become mature when multiple suppliers gain expertise and compete on individual pieces of the supply chain. A supply chain consists of many different elements so when there are many companies competing in one niche of the supply chain, over time that creates optimal service and price (theoretically). For example there are hundreds of companies that design and produce plastic cases for electronics around Shenzhen. Several of them are particularly focused on designing cases specifically for Android tablets or smartphones. There are so many case suppliers and so much demand for Android device cases, some case suppliers carve a niche by specializing in tablet or smartphone cases.

This creates teams of engineers with specific retained knowledge that apply directly to making Android devices. Each case company has engineers with experience designing cases for optimal performance and manufacturing efficiency. For example an experienced mechanical engineer designs the camera slot in a way to ensure the camera easily snaps into place, blocks light from the flash, and doesn’t overheat. They know what works, and have seen many things which don’t, creating a reliable and efficient supply chain. More experienced component manufacturers working in a supply chain makes that supply chain more mature.

What’s an immature supply chain?

Supply chains are immature when there are limited suppliers with deep (or any) expertise in bringing a finished product to life. For example when developing a new product, especially taking that product from prototype to mass production, countless surprises and mistakes happen due to inexperience. It could be that the product was designed by non-Chinese engineers who choose components that are difficult to get in China, necessitating a design modification. Even for products fully designed in China, components don’t always work well together. Some materials don’t mix well together for chemical or electrical reasons. Some components come with different calibrations that require tweaking for consistency during mass production. Immature supply chains result in surprises that take time to resolve.

Production line staff at factories don’t usually understand the point of the custom modifications as it pertains to the product’s use case. Because of this sometimes small variations in workmanship have a bigger impact on product performance than the staff realize. Over time mistakes become lessons, but until that happens the supply chain is immature.

How does a supply chain become mature?

Immature supply chains become mature over time as orders of the finished product increase. For example when Android tablets first started shipping from local Shenzhen supply chains around the end of 2010 the product quality was low and unit cost was high. As demand exploded new suppliers entered the supply chain. Even with these new entrants it took a while to meet demand and have prices start to come down. Over time the profit margins decreased and maturity of the supply chain evolved. Once supply caught up with demand they needed to improve product quality and price in order to compete. Sales volume and, in turn, competition are the key forces that drive a supply chain to maturity.

The more orders suppliers produce the more opportunity they have to learn from mistakes. This drives improvement of their components and, ultimately, the finished Android tablet. As volumes of Android tablets and smartphones exploded a massive supply ecosystem came into existence. The same events take place in the creation of supply chains for lower volume products, albeit with relatively fewer participants, as demand is lower. A large company producing high volumes of a unique product will also create a mature supply chain. This happens somewhat through brute force rather than purely organic capitalism. In this case entering the supply chain is more restrictive than with a product anyone can buy since there’s only one customer who chooses the individual suppliers.

How to work with an immature supply chain

It’s necessary to work with an immature supply chain whenever creating a new product or modifying an existing one. Getting from idea to mass production means going through a learning curve. Over time production runs become more efficient by identifying and fixing problems. That’s why initial production runs should start with smaller quantities. Problems are easier and less costly to fix with lower volume.

In addition to extensive testing with low volumes, having multiple suppliers for high risk parts is also useful to hedge risk. High risk parts refers to parts that have a higher tendency to go out of production or become difficult to source. Often a component’s future availability is tough to predict. From experience, cameras and screens seem to have the highest risk in custom Android devices.

Supplier value in a mature supply chain

Once a supply chain becomes mature so do the buyers. Experienced retail buyers know what’s important to look for in a supplier. The supplier traits which matter most in a mature supply chain are quality, speed, price, and reliability. Because finished products coming from a mature supply chain are so similar to each other there’s rarely room for significant product differentiation. Strides in innovation are made in small, manufacturing related, baby steps. Any big technological innovation will not likely come from a manufacturer, at least not for Android products.

How an immature supply chain is helped by a mature supply chain

If you want to make a custom Android product your development and manufacturing partner, such as Hatch, plays a big role in leveraging mature supply chains to create custom products. Some suppliers in a mature supply chain are willing to support smaller production runs at a higher margin. By working with them Hatch leverages the experience and efficiency of the mature supply chain to reliably produce what is needed for the lower volume custom product.

Conclusion

Anytime a new commodity product or product category kicks off a supply chain must be created from scratch. The initial entrants do what they can to provide a ‘good enough’ early stage product, but as demand for a product grows and more companies enter into the supply chain the quality gets better. When making something custom leverage mature supply chains to gain a head start.

Whenever working with a new and immature supply chain, go slowly to find problems early. Reduce risk by thoroughly testing multiple rounds of a trial production and making clear requirements, sometimes even SOPs, for the suppliers to follow. All mature supply chains start as new and immature ones. They’re both important at different stages of a product’s lifecycle and through constant intersection help each other to grow.

Turning a Product Idea into Reality in 2020

This month’s post takes a pause from custom Android hardware to talk about a fun side project Hatch has been working on: Snipes, a brand new ice hockey training product. While we’re usually making products for our customers’ businesses we decided to have some fun doing our own project together with a couple of friends.

Due to Covid related travel restrictions, I ended up staying in China more this year than usual. In an effort to make the most of this, I got together with an ice hockey friend to develop a unique ice hockey training product that we wanted to use ourselves. This is a story of envisioning a product that didn’t exist, developing it through a great team effort, learning about the online marketing side, and ultimately receiving a great response from the target market.

The idea was clear. Create targets that go inside an ice hockey net to shoot at. Each target has lights and a sensor. When the lights of a target turn on, the player shoots a puck at it. If the target is hit then the lights turn off and the lights of another random target turn on. From this basic setup, various different game modes can be created. We named the product Snipes.

Taking an Idea to Something Real

Step one was finding the right target material that could sustain the force of being hit by 6 ounces of hardened rubber flying 100mph / 160kph.

We ordered different materials to test and found one that we felt comfortable with.

Next step was hooking up an Arduino to lights and sensors, but first we needed to decide which kind of sensor to use. After testing a few different options we went with a Piezo sensor. This senses the level of vibration.

Before attaching everything on the targets we created a mini version with just the lights and sensors to make sure that we could simulate the desired functionality.

First ‘working’ prototype was created and destroyed. That happened about 5 more times.

At this point we decided to go with wireless connections between the targets, meaning custom electronics and firmware were created. This development took a few weeks. When the first samples were ready the initial result was promising.

The first Arduino prototype didn’t use any case for the electronics at all. All the components were held onto the target using tape! We evolved the mechanics using a FDM 3D printed case, which was better than nothing, but broke. That’s when we went with CNC milled cases. These provided a nearly mass production level of strength.

Something Real to Selling Promises

We went through several rounds of fast and cheap prototypes before the final set of custom electronics, firmware, and casing was ready. Each time a problem was found, an improvement was made. Once the problems became harder to find and the testing went smoothly we took a video of people using the product and started our pre-sale launch.

Early response from the launch indicated that people liked the product. We went ahead with opening the tools for the casing mold and decided to commit to a mass production order as our pre-sales were going well. We forecasted how many would sell in the launch campaign and wanted to make extra inventory to have available after the campaign as well.

The target ship date was set for early December, much earlier than I felt comfortable with, but still possible to accomplish if we worked hard and had good luck. Products will ship individually from the factory to the pre-sale buyers in hopes of delivery before Christmas.

Instead of using a normal crowdfunding site we used paid social media ads to send customers to our own pre-sale page. My partners thought that since our product was fairly niche all sales would come from targeted advertising rather than being on a crowdfunding platform. Instead of paying a percentage of sales to the crowdfunding platform we’d use that money to pay for direct advertising. I wasn’t sure how this would go over, but the logic seems to have worked. Maybe next time, if the product is intended for a wider audience, we’ll try going with a platform or hybrid approach.

The Shooter Tutor, a well-known ice hockey training product Snipes is most similar to, has been around for decades. When hockey players see videos of players using Snipes they instantly understand how to use the product. For this reason online advertising using videos has been successful. There’s little need to further educate the customer after they see a short video. While the application is obvious there’s nothing like it on the market so we’re in a good position.

Selling Promises to Products Delivered

This is the stage we’re in now. I’m excited about getting Snipes out to the hundreds of customers who believed in us and joined our pre-sale. Most of the materials for manufacturing are ready. We are working to implement some last-minute changes on Snipes’ firmware and then must test that.

Shipping in time for Christmas delivery is still a possibility. Need to see how testing goes with the new firmware and whether any unexpected delays pop up. Good quality is more important than shipping earlier. We’re confident that customers will love the product when they get it.

Next Steps

Making this sports training product has been a fun project. The development time is much faster than making custom Android products as the functions are more simple and case design requirements are more about strength than aesthetic design. The Bolt team has ideas about new products that will expand the brand’s footprint deeper into ice hockey as well as other sports.

Since people couldn’t travel this year I spent more time than usual in Shenzhen. That gave me the opportunity to take on a fun side project. Now and in the future, Hatch continues to work on custom Android development and manufacturing. With the growing prominence of IoT devices, we’re open to evaluating IoT hardware partnerships as well.

Best CPUs for Custom Android Tablets Q4 2020

Since the explosion of Android tablets started almost 10 years ago several CPU (central processor unit) manufacturers have come and gone. In the beginning high profit and high volume drew companies into the space, but as the volume of Wi-Fi Android tablets dropped and competition grew a few clear leaders have emerged. Those leaders include Rockchip, Mediatek (which also makes CPUs for telecom tablets and smartphones), and Allwinner Tech. These companies all make chips based on the ARM architecture, so many of their chips compete head to head and are fairly similar in spec and performance.

To keep it simple this article will focus on Rockchip since Hatch routinely uses their CPUs. The main reason we use more Rockchip is due to flexible customizations (important when making custom Android devices), engineering support, and because we have stronger relationships with Rockchip engineers. The other companies also make high quality Android CPUs that work for custom projects and we are supportive of using them if our customer requests.

The list below provides information about the leading Rockchip CPUs that are recommended for use in custom Android Wi-Fi devices in order of performance, from high to low end.

RK3399Pro

The RK3399Pro is called a ‘server level’ CPU. It’s mainly intended for use in applications that demand high performance such as an Edge AI server, industrial applications, client-side facial recognition, and others of this nature.

The CPU contains 6 (hexa) ARM cores, consisting of 2 Cortex-A72 (1.8GHz) and 4 Cortex-A53 (1.5GHz), a NEON coprocessor, Mali T864 GPU, and an NPU. It can run multiple learning platforms such as Caffe and Tensor Flow. The RK3399Pro supports multiple display outputs up to 4k resolution and multiple camera inputs up to 13MP. It also has native support for USB type-C protocol.

(Before the RK3399Pro came the RK3399. The RK3399Pro is the RK3399 with the integration of the RK1808 IC. The RK1808 provides the NPU (neural network processor unit) mentioned above.)

RK3288

The RK3288 is a high end Android CPU that features excellent display support and strong processing power. This chip is used in a range of consumer, business, and industrial devices. Many large screen advertising displays use this chip. Applications include live video streaming with add-on electronics (like temperature sensor), laptops, and access control terminals.

The CPU contains 4 (quad) ARM Cortex-A17 cores that deliver speed up to 1.8GHz and a Mali T764 GPU. It supports up to 4k display resolution, dual display output, and dual camera up to 13MP (with internal ISP).

RK3368

The RK3368 is similar to the RK3288 with slightly lower specs. It still offers excellent multimedia features and does a great job in high level consumer or business applications. The RK3368 is commonly used for educational tablets, TV boxes, advertising displays, and premium tablets.

This CPU has an 8 (octacore) architecture with 8 Cortex-A53 cores that run up to 1.5GHz. It supports up to 4k video HDMI output powered by a PowerVR G6110 GPU. The internal ISP supports 1080p recording and up to 8MP images.

RK3326

The RK3326 is a mid-range CPU that has become popular with devices like retail tablets and smart speakers that have moderate performance requirements and need the newest technologies. The chip is a step up from the RK3128 in that it provides faster processing speed and an internal ISP for image processing.

This CPU has a 4 (quad) core Cortex-A35 processor that runs up to 1.5GHz. The Mali-G31MP2 GPU delivers video output up to 1080p resolution. The internal ISP supports video up to 1080p resolution and images up to 8MP.

RK3128

The RK3128 is the entry level CPU intended for mass market consumer level devices. Its high volume ensures stable functionality and reliable performance in tablets and TV boxes for lower resolution displays. It’s a solid option for custom Android devices that need long battery life with limited functionality.

This CPU has 4 (quad) Cortex-A7 cores running up to 1.2GHz. It integrates a Mali-400MP2 GPU that provides video output up to 1080p resolution. The CPU also supports cameras with recording up to 1080p and images up to 5MP.

Some CPUs have multiple versions that offer slightly different features. For example, the RK3128 and RK3126c are exactly the same CPU, but only the RK3128 has HDMI connectivity and supports DDR2. For products that don’t leverage the full features of a CPU using the ‘cost down’ version (like the RK3126c) saves cost on the BOM (bill of materials). Once the requirements of a product are clearly defined with a client Hatch will help to accurately identify the most suitable chip to use.